量化大型稳健成长

Last Update: 2021-06-10

雪球实盘建立日期: 2021年6月10日

策略说明:

量化选择过去3年中运营稳健、成长性表现最好的10只A股大市值标的,每3个月调仓一次,仓位模型为InvVol,时间窗口过去3个月。

量化选股

选择指标

- 负债率 < 50%

- 应收比 < 10%

- 商誉比 < 10%

- ROE >= 15%

- 利润率 >= 15%

- 收入增长(三年平均) >= 5% 且 盈利增长(三年平均) >= 5%

- 收入增长TTM >= 0% 且 盈利增长TTM >= 0%

- FCF增长 > 0%

- 市值 > 100B USD

- DCF折价率 > -200%

排序

- 市值倒排

| 名称 | 负债率 | ROE | 利润率 | 收入增长 | 收入增长TTM | 盈利增长 | 盈利增长TTM | FCF增长 | PE | PEm | PEG | CAGR | 最大回撤 | Calmar | 折价率 | 回报率 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Symbol | |||||||||||||||||

| 600519.SS | 贵州茅台 | 21.40 | 30.01 | 47.94 | 17.87 | 3.02 | 20.13 | 1.84 | 37.59 | 59.47 | 75.33 | 3.74 | 44.91 | -33.50 | 1.34 | -137.77 | 202.21 |

| 600900.SS | 长江电力 | 46.10 | 15.52 | 44.31 | 5.12 | 0.84 | 6.31 | 2.20 | 0.54 | 16.54 | 19.50 | 3.09 | 9.47 | -16.39 | 0.58 | 3.28 | 30.97 |

| 002714.SZ | 牧原股份 | 46.09 | 28.10 | 26.61 | 87.55 | 21.47 | 448.77 | 10.32 | 199.27 | 8.29 | 27.97 | 0.06 | 82.88 | -29.80 | 2.78 | - | 504.82 |

| 600585.SS | 海螺水泥 | 16.30 | 22.59 | 21.40 | 35.01 | 6.37 | 35.10 | 2.55 | 36.04 | 7.10 | 8.49 | 0.24 | 14.76 | -27.78 | 0.53 | 68.41 | 50.76 |

| 601225.SS | 陕西煤业 | 39.78 | 21.57 | 17.80 | 23.29 | 17.32 | 12.98 | 6.82 | 3.92 | 7.77 | 9.98 | 0.77 | 17.51 | -28.52 | 0.61 | 37.95 | 61.77 |

| 603195.SS | 公牛集团 | 26.53 | 50.07 | 20.55 | 12.02 | 11.88 | 22.75 | 18.87 | 61.00 | 49.70 | 61.28 | 2.69 | - | -34.35 | - | -34.61 | - |

| 300033.SZ | 同花顺 | 26.99 | 24.34 | 52.33 | 29.08 | 5.13 | 40.34 | 2.48 | 63.18 | 34.67 | 61.58 | 1.53 | 38.77 | -41.83 | 0.93 | -27.89 | 165.61 |

| 601636.SS | 旗滨集团 | 33.42 | 16.93 | 15.72 | 8.39 | 16.83 | 17.58 | 39.42 | 28.11 | 25.49 | 33.97 | 1.93 | 60.73 | -33.07 | 1.84 | -40.74 | 311.63 |

| 002372.SZ | 伟星新材 | 23.20 | 26.35 | 21.72 | 9.53 | 6.51 | 13.64 | 2.24 | 20.85 | 29.85 | 37.73 | 2.77 | 15.65 | -40.34 | 0.39 | -112.28 | 54.45 |

| 600801.SS | 华新水泥 | 41.40 | 25.55 | 17.04 | 13.11 | 7.97 | 53.52 | 6.75 | 29.58 | 7.67 | 6.15 | 0.11 | 27.00 | -33.90 | 0.80 | 76.12 | 103.92 |

| 000672.SZ | 上峰水泥 | 36.62 | 37.68 | 26.99 | 14.05 | 2.69 | 43.73 | 0.90 | 34.90 | 7.66 | 9.60 | 0.22 | 31.66 | -44.75 | 0.71 | 66.27 | 127.05 |

| 002233.SZ | 塔牌集团 | 17.09 | 15.70 | 23.06 | 17.15 | 7.23 | 47.47 | 1.59 | 161.27 | 7.14 | 8.76 | 0.18 | 4.24 | -29.22 | 0.15 | 94.31 | 13.19 |

| 002677.SZ | 浙江美大 | 21.80 | 28.29 | 28.67 | 20.62 | 14.49 | 21.24 | 14.76 | 44.23 | 19.73 | 29.71 | 1.40 | 1.73 | -53.24 | 0.03 | -6.01 | 5.25 |

| 002950.SZ | 奥美医疗 | 39.81 | 23.62 | 17.23 | 32.51 | 5.82 | 98.59 | 2.17 | 921.00 | 10.41 | 25.32 | 0.26 | - | -50.88 | - | 99.43 | - |

历史回测

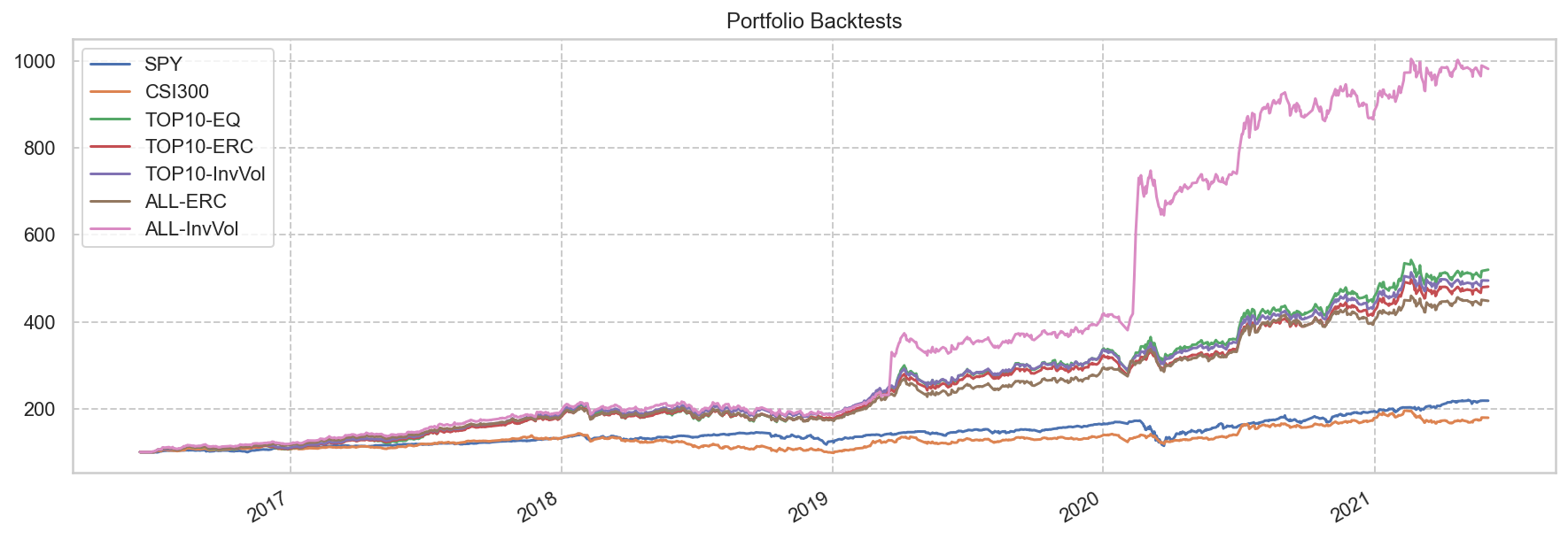

Stat SPY CSI300 TOP10-EQ TOP10-ERC TOP10-InvVol ALL-ERC ALL-InvVol

------------------- ---------- ---------- ---------- ----------- -------------- ---------- ------------

Start 2016-06-12 2016-06-12 2016-06-12 2016-06-12 2016-06-12 2016-06-12 2016-06-12

End 2021-06-03 2021-06-03 2021-06-03 2021-06-03 2021-06-03 2021-06-03 2021-06-03

Risk-free rate 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

Total Return 118.15% 79.00% 419.75% 380.77% 394.79% 348.04% 882.26%

Daily Sharpe 0.97 0.74 1.66 1.80 1.82 1.71 2.04

Daily Sortino 1.44 1.21 2.94 3.20 3.25 3.03 4.43

CAGR 16.98% 12.42% 39.28% 37.11% 37.91% 35.18% 58.29%

Max Drawdown -33.71% -31.29% -18.84% -15.05% -14.45% -15.58% -15.01%

Calmar Ratio 0.50 0.40 2.09 2.47 2.62 2.26 3.88

MTD -0.07% -0.21% 0.50% 0.27% -0.07% -0.45% -0.71%

3m 10.15% -2.51% -1.91% -1.60% -1.78% -1.16% -1.58%

6m 15.06% 3.67% 11.94% 10.93% 9.90% 6.71% 6.05%

YTD 12.37% 0.57% 13.90% 13.48% 12.49% 11.49% 11.22%

1Y 36.29% 33.66% 46.85% 45.65% 42.87% 37.78% 33.67%

3Y (ann.) 17.22% 13.01% 39.73% 35.79% 35.12% 31.81% 67.68%

5Y (ann.) 16.98% 12.42% 39.28% 37.11% 37.91% 35.18% 58.29%

10Y (ann.) - - - - - - -

Since Incep. (ann.) 16.98% 12.42% 39.28% 37.11% 37.91% 35.18% 58.29%

Daily Sharpe 0.97 0.74 1.66 1.80 1.82 1.71 2.04

Daily Sortino 1.44 1.21 2.94 3.20 3.25 3.03 4.43

Daily Mean (ann.) 18.69% 14.50% 38.22% 35.88% 36.53% 34.39% 52.56%

Daily Vol (ann.) 19.18% 19.70% 22.98% 19.90% 20.05% 20.07% 25.78%

Daily Skew -0.77 0.03 0.03 0.01 0.03 0.00 2.86

Daily Kurt 18.46 6.80 2.06 2.02 1.94 1.65 27.95

Best Day 9.06% 9.47% 6.58% 6.02% 5.89% 5.61% 20.62%

Worst Day -10.94% -8.43% -7.29% -6.13% -5.85% -5.13% -5.55%

Monthly Sharpe 1.09 0.79 1.80 1.92 1.95 1.88 1.29

Monthly Sortino 1.81 1.59 4.71 4.77 4.93 5.03 8.96

Monthly Mean (ann.) 16.89% 13.00% 35.24% 33.25% 33.85% 31.73% 52.28%

Monthly Vol (ann.) 15.45% 16.37% 19.59% 17.30% 17.37% 16.89% 40.50%

Monthly Skew -0.76 0.28 0.29 0.04 0.04 0.31 4.41

Monthly Kurt 2.27 0.56 0.08 0.07 0.00 0.22 22.96

Best Month 12.70% 14.40% 16.45% 14.53% 14.69% 15.74% 73.15%

Worst Month -12.49% -8.64% -8.59% -8.19% -8.18% -6.69% -6.95%

Yearly Sharpe 1.14 0.53 1.09 1.16 1.16 1.17 1.08

Yearly Sortino 6.58 1.25 46.33 inf inf 40.51 129.39

Yearly Mean 15.88% 13.49% 41.13% 37.79% 38.24% 33.63% 60.76%

Yearly Vol 13.94% 25.27% 37.82% 32.63% 33.02% 28.75% 56.32%

Yearly Skew -0.77 -0.90 0.27 0.28 0.24 -0.16 0.02

Yearly Kurt 1.28 -0.33 -1.79 -2.12 -2.62 -2.01 -2.80

Best Year 32.37% 38.60% 89.88% 78.95% 77.14% 67.23% 122.31%

Worst Year -5.40% -24.16% -1.98% 1.62% 2.40% -1.86% -1.05%

Avg. Drawdown -1.41% -3.28% -3.37% -2.77% -2.70% -2.55% -2.83%

Avg. Drawdown Days 13.23 47.86 23.88 21.99 21.18 19.65 22.03

Avg. Up Month 3.14% 3.80% 5.10% 4.90% 5.19% 4.72% 7.00%

Avg. Down Month -4.84% -3.61% -4.16% -3.62% -3.17% -3.06% -2.90%

Win Year % 80.00% 80.00% 80.00% 100.00% 100.00% 80.00% 80.00%

Win 12m % 96.00% 80.00% 94.00% 94.00% 96.00% 94.00% 94.00%

当前仓位

Date: 2021-06-04 00:00:00

| Weight | 名称 | 负债率 | ROE | 利润率 | 收入增长 | 收入增长TTM | 盈利增长 | 盈利增长TTM | FCF增长 | PE | PEm | PEG | CAGR | 最大回撤 | Calmar | 折价率 | 回报率 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 600585.SS | 17.73 | 海螺水泥 | 16.30 | 22.59 | 21.40 | 35.01 | 6.37 | 35.10 | 2.55 | 36.04 | 7.10 | 8.49 | 0.24 | 14.76 | -27.78 | 0.53 | 68.41 | 50.76 |

| 600900.SS | 16.17 | 长江电力 | 46.10 | 15.52 | 44.31 | 5.12 | 0.84 | 6.31 | 2.20 | 0.54 | 16.54 | 19.50 | 3.09 | 9.47 | -16.39 | 0.58 | 3.28 | 30.97 |

| 600801.SS | 10.75 | 华新水泥 | 41.40 | 25.55 | 17.04 | 13.11 | 7.97 | 53.52 | 6.75 | 29.58 | 7.67 | 6.15 | 0.11 | 27.00 | -33.90 | 0.80 | 76.12 | 103.92 |

| 600519.SS | 9.65 | 贵州茅台 | 21.40 | 30.01 | 47.94 | 17.87 | 3.02 | 20.13 | 1.84 | 37.59 | 59.47 | 75.33 | 3.74 | 44.91 | -33.50 | 1.34 | -137.77 | 202.21 |

| 601225.SS | 8.67 | 陕西煤业 | 39.78 | 21.57 | 17.80 | 23.29 | 17.32 | 12.98 | 6.82 | 3.92 | 7.77 | 9.98 | 0.77 | 17.51 | -28.52 | 0.61 | 37.95 | 61.77 |

| 002714.SZ | 8.07 | 牧原股份 | 46.09 | 28.10 | 26.61 | 87.55 | 21.47 | 448.77 | 10.32 | 199.27 | 8.29 | 27.97 | 0.06 | 82.88 | -29.80 | 2.78 | - | 504.82 |

| 300033.SZ | 7.62 | 同花顺 | 26.99 | 24.34 | 52.33 | 29.08 | 5.13 | 40.34 | 2.48 | 63.18 | 34.67 | 61.58 | 1.53 | 38.77 | -41.83 | 0.93 | -27.89 | 165.61 |

| 601636.SS | 7.26 | 旗滨集团 | 33.42 | 16.93 | 15.72 | 8.39 | 16.83 | 17.58 | 39.42 | 28.11 | 25.49 | 33.97 | 1.93 | 60.73 | -33.07 | 1.84 | -40.74 | 311.63 |

| 002372.SZ | 7.14 | 伟星新材 | 23.20 | 26.35 | 21.72 | 9.53 | 6.51 | 13.64 | 2.24 | 20.85 | 29.85 | 37.73 | 2.77 | 15.65 | -40.34 | 0.39 | -112.28 | 54.45 |

| 603195.SS | 6.92 | 公牛集团 | 26.53 | 50.07 | 20.55 | 12.02 | 11.88 | 22.75 | 18.87 | 61.00 | 49.70 | 61.28 | 2.69 | - | -34.35 | - | -34.61 | - |