量化稳健成长

Last Update: 2021-06-10

雪球实盘建立日期: 2021年6月10日

策略说明:

量化选择过去3年中成长性表现最好的10只A股标的,每月调仓一次,仓位模型为InvVol,时间窗口过去3个月。

量化选股

选择指标

- 负债率 < 50%

- 应收比 < 20%

- 商誉比 < 10%

- ROE >= 20%

- 利润率 >= 20%

- 收入增长(三年平均) >= 10% 且 盈利增长(三年平均) >= 10%

- 收入增长TTM >= 5% 且 盈利增长TTM >= 5%

- CAGR > 5%

- 最大回撤 < 50%

- 市值 > 10B USD

排序

- ROE倒排

| 名称 | 负债率 | ROE | 利润率 | 收入增长 | 收入增长TTM | 盈利增长 | 盈利增长TTM | FCF增长 | PE | PEm | PEG | CAGR | 最大回撤 | Calmar | 折价率 | 回报率 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Symbol | |||||||||||||||||

| 603288.SS | 海天味业 | 31.72 | 31.42 | 26.24 | 16.05 | 5.59 | 21.95 | 5.32 | 11.37 | 66.07 | 90.64 | 4.13 | 44.08 | -31.85 | 1.38 | -366.47 | 197.11 |

| 002714.SZ | 牧原股份 | 46.09 | 28.10 | 26.61 | 87.55 | 21.47 | 448.77 | 10.32 | 199.27 | 8.29 | 27.97 | 0.06 | 82.88 | -29.80 | 2.78 | - | 504.82 |

| 600570.SS | 恒生电子 | 49.48 | 24.06 | 26.42 | 16.27 | 5.69 | 49.90 | 16.16 | 10.32 | 58.78 | 95.23 | 1.91 | 37.63 | -38.38 | 0.98 | -604.99 | 159.14 |

| 600763.SS | 通策医疗 | 23.37 | 23.98 | 21.89 | 21.36 | 20.99 | 33.13 | 37.14 | 38.60 | 176.39 | 315.32 | 9.52 | 104.02 | -45.88 | 2.27 | -846.40 | 738.06 |

| 300595.SZ | 欧普康视 | 10.02 | 21.91 | 48.20 | 40.94 | 21.01 | 42.15 | 23.11 | 54.08 | 114.88 | 220.13 | 5.22 | 113.95 | -42.52 | 2.68 | -706.63 | 865.64 |

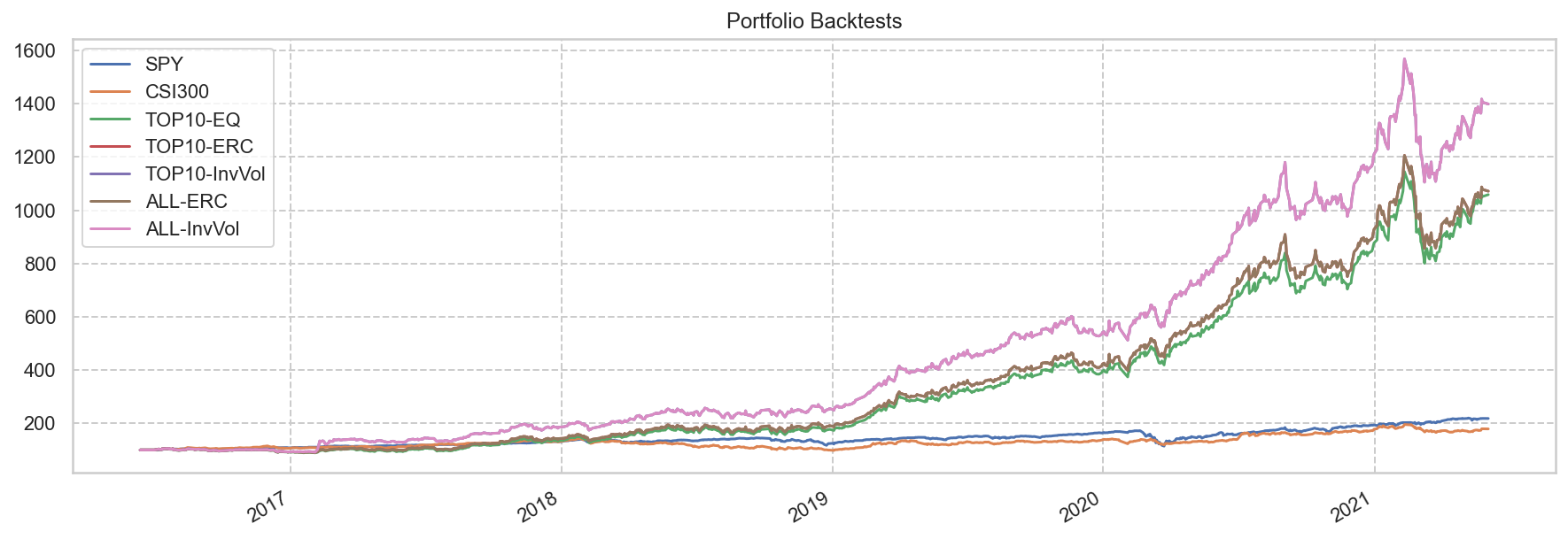

历史回测

Stat SPY CSI300 TOP10-EQ TOP10-ERC TOP10-InvVol ALL-ERC ALL-InvVol

------------------- ---------- ---------- ---------- ----------- -------------- ---------- ------------

Start 2016-06-12 2016-06-12 2016-06-12 2016-06-12 2016-06-12 2016-06-12 2016-06-12

End 2021-06-03 2021-06-03 2021-06-03 2021-06-03 2021-06-03 2021-06-03 2021-06-03

Risk-free rate 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

Total Return 118.15% 79.00% 958.47% 971.53% 1298.68% 971.53% 1298.68%

Daily Sharpe 0.97 0.74 1.83 1.89 2.01 1.89 2.01

Daily Sortino 1.44 1.21 3.12 3.23 3.60 3.23 3.60

CAGR 16.98% 12.42% 60.69% 61.08% 69.95% 61.08% 69.95%

Max Drawdown -33.71% -31.29% -30.05% -28.92% -29.51% -28.92% -29.51%

Calmar Ratio 0.50 0.40 2.02 2.11 2.37 2.11 2.37

MTD -0.07% -0.21% 0.70% -0.61% -0.47% -0.61% -0.47%

3m 10.15% -2.51% 13.53% 8.43% 9.60% 8.43% 9.60%

6m 15.06% 3.67% 36.48% 29.71% 30.06% 29.71% 30.06%

YTD 12.37% 0.57% 20.65% 15.45% 15.55% 15.45% 15.55%

1Y 36.29% 33.66% 81.52% 71.71% 74.96% 71.71% 74.96%

3Y (ann.) 17.22% 13.01% 82.84% 79.65% 79.09% 79.65% 79.09%

5Y (ann.) 16.98% 12.42% 60.69% 61.08% 69.95% 61.08% 69.95%

10Y (ann.) - - - - - - -

Since Incep. (ann.) 16.98% 12.42% 60.69% 61.08% 69.95% 61.08% 69.95%

Daily Sharpe 0.97 0.74 1.83 1.89 2.01 1.89 2.01

Daily Sortino 1.44 1.21 3.12 3.23 3.60 3.23 3.60

Daily Mean (ann.) 18.69% 14.50% 55.59% 55.57% 61.68% 55.57% 61.68%

Daily Vol (ann.) 19.18% 19.70% 30.42% 29.47% 30.73% 29.47% 30.73%

Daily Skew -0.77 0.03 -0.23 -0.22 0.21 -0.22 0.21

Daily Kurt 18.46 6.80 2.04 1.91 3.11 1.91 3.11

Best Day 9.06% 9.47% 7.64% 7.47% 9.87% 7.47% 9.87%

Worst Day -10.94% -8.43% -8.70% -8.30% -8.03% -8.30% -8.03%

Monthly Sharpe 1.09 0.79 1.89 1.96 1.79 1.96 1.79

Monthly Sortino 1.81 1.59 5.87 5.98 6.87 5.98 6.87

Monthly Mean (ann.) 16.89% 13.00% 51.57% 51.64% 58.59% 51.64% 58.59%

Monthly Vol (ann.) 15.45% 16.37% 27.23% 26.39% 32.75% 26.39% 32.75%

Monthly Skew -0.76 0.28 0.41 0.30 1.73 0.30 1.73

Monthly Kurt 2.27 0.56 -0.33 -0.45 6.36 -0.45 6.36

Best Month 12.70% 14.40% 22.93% 21.44% 48.45% 21.44% 48.45%

Worst Month -12.49% -8.64% -9.79% -10.50% -10.24% -10.50% -10.24%

Yearly Sharpe 1.14 0.53 1.38 1.41 1.62 1.41 1.62

Yearly Sortino 6.58 1.25 inf inf inf inf inf

Yearly Mean 15.88% 13.49% 68.69% 68.74% 77.58% 68.74% 77.58%

Yearly Vol 13.94% 25.27% 49.85% 48.90% 47.98% 48.90% 47.98%

Yearly Skew -0.77 -0.90 0.45 0.27 -0.58 0.27 -0.58

Yearly Kurt 1.28 -0.33 -3.12 -2.84 -2.47 -2.84 -2.47

Best Year 32.37% 38.60% 123.43% 120.63% 123.59% 120.63% 123.59%

Worst Year -5.40% -24.16% 20.65% 15.45% 15.55% 15.45% 15.55%

Avg. Drawdown -1.41% -3.28% -3.48% -3.32% -3.51% -3.32% -3.51%

Avg. Drawdown Days 13.23 47.86 16.63 15.55 15.17 15.55 15.17

Avg. Up Month 3.14% 3.80% 7.84% 7.97% 8.81% 7.97% 8.81%

Avg. Down Month -4.84% -3.61% -4.66% -4.25% -4.28% -4.25% -4.28%

Win Year % 80.00% 80.00% 100.00% 100.00% 100.00% 100.00% 100.00%

Win 12m % 96.00% 80.00% 96.00% 98.00% 100.00% 98.00% 100.00%

当前仓位

Date: 2021-06-04 00:00:00

| Weight | 名称 | 负债率 | ROE | 利润率 | 收入增长 | 收入增长TTM | 盈利增长 | 盈利增长TTM | FCF增长 | PE | PEm | PEG | CAGR | 最大回撤 | Calmar | 折价率 | 回报率 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 603288.SS | 24.09 | 海天味业 | 31.72 | 31.42 | 26.24 | 16.05 | 5.59 | 21.95 | 5.32 | 11.37 | 66.07 | 90.64 | 4.13 | 44.08 | -31.85 | 1.38 | -366.47 | 197.11 |

| 600570.SS | 22.79 | 恒生电子 | 49.48 | 24.06 | 26.42 | 16.27 | 5.69 | 49.90 | 16.16 | 10.32 | 58.78 | 95.23 | 1.91 | 37.63 | -38.38 | 0.98 | -604.99 | 159.14 |

| 002714.SZ | 21.38 | 牧原股份 | 46.09 | 28.10 | 26.61 | 87.55 | 21.47 | 448.77 | 10.32 | 199.27 | 8.29 | 27.97 | 0.06 | 82.88 | -29.80 | 2.78 | - | 504.82 |

| 300595.SZ | 16.74 | 欧普康视 | 10.02 | 21.91 | 48.20 | 40.94 | 21.01 | 42.15 | 23.11 | 54.08 | 114.88 | 220.13 | 5.22 | 113.95 | -42.52 | 2.68 | -706.63 | 865.64 |

| 600763.SS | 14.99 | 通策医疗 | 23.37 | 23.98 | 21.89 | 21.36 | 20.99 | 33.13 | 37.14 | 38.60 | 176.39 | 315.32 | 9.52 | 104.02 | -45.88 | 2.27 | -846.40 | 738.06 |